Portfolio Construction with P2P personal loans. Not only in our community but also in the Forum of Claus Lehmann, the question is discussed diligently: how much I should really invest in P2P? I will in this article a try to give you my perspective on things and you also show my entire portfolio construction to you to facilitate your decision or something so you have a comparison value to your portfolio.

Why not just "full pipe"?

The easiest way and certainly the best, if they would just work like that. Create all the capital in P2P lending with 15 - go 20% return home. That would be something, right? Even though I'm known to be a fan of the P2P Investments, I would never recommend someone to you to invest your whole coal here, because even if I have confidence in this relatively new asset class, I'm not insane, and I know people the you would report to the contrary 🙂 especially when you look at what is currently at lending Club, the (still) largest P2P platform in the worldgoing on is, one should make his portfolio construction times exactly to the test. The issue is therefore more relevant than ever.

Having said that, I still contend with me if some platforms are really designed to park a lot of money there. Especially with newer platforms such as CrossLend the credit ceiling is nevertheless still partially arg thin, as I discovered this week when investing. The asset class "personal loans" should therefore rather be used to enhance the overall portfolio meaningful and effective , but not to in order to build your entire fortune on it. Due to the low correlation with the stock market P2P is perfect for an extension .

P2P is still no asset class!

This statement I heard from a non-P2Pler recently and had to sadly say, "ohhh, but!". What exactly is an asset class? An asset class is a type of investment category. For example, equities, government bonds, real estate and commodities. So a abgekapseltes investment segment, which is not comparable in all respects to another . The asset classes themselves can be subdivided into more classes again. For example, US stocks and emerging markets. Personal loans are also an abgekapseltes investment segment and therefore they can be very well regarded as a separate asset class.

P2P does not fit into any other asset class and is therefore often referred to as "alternative investment", but this is a slightly bitter aftertaste, has the P2P really do not deserve. Many other alternative investments are often associated with a very high risk (eg option trading), high entry capital (eg private equity) and strong variations provided, which normally is in consumer lending but not the case, if you approach it right.But let's get off the subject. We maintain easy at this point.Personal loans are a separate asset class.

What is the optimal portfolio construction?

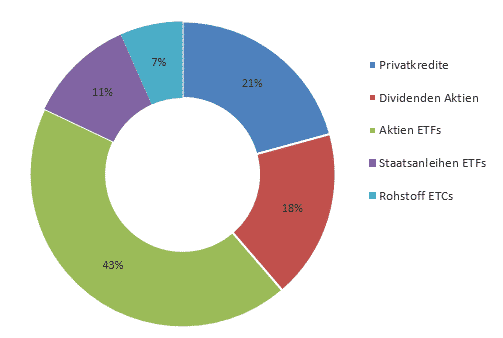

I can of course only say from my own experience and assessment, because I taught investment in P2P personal loans myself and therefore I am experimenting well even with the division. However, I feel currently with my portfolio construction very well and that is extremely important. Here is a look at my asset allocation:

With currently 21% my share of retail loans is relatively high , and he's already dropped a little bit, because I have recently purchased diligently ETFs. The private loans are currently divided among providers Auxmoney , Bondora ,Twino , Minto and brand new CrossLend . Bondora even takes more than 50% still currently the largest share of a (first I have not taken the platform diversification so serious) and Twino the smallest since I have not continued to invest out of the test sum.

How others see the whole thing?

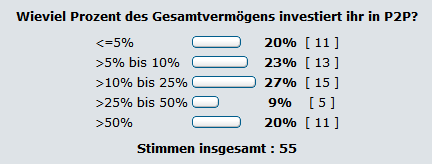

As indicated above, there is a discussion in our community and in the forum of Claus Lehmann and opinions vary widely.Below you see the breakdown of a vote of the Board members at Claus and how their portfolio structure looks like:

The largest share of Claus survey therefore settles anywhere from 5 to 25 percent , with investors very well versed there also usually with P2P loans. Of course, we also do not know where living conditions are all the investors. A young gutverdienender single will probably generally invest more in personal loans and restructure its portfolio construction other than the father or the mother 2-4 kids.Because even if you can limit the risk, it is still present.

Besides the risk of the general credit loss there are many other risks associated with P2P loans. For example, the collapse of a platform, high unemployment in an economic crisis or limitation of P2P market by the state (not likely, but still possible). Let's just hold, we quite simply do not know what's waiting for us in the future and should therefore align our portfolio construction it. Just things like the current situation at Lending Club shows us how fragile everything can be when rotated only at a few wrong screws.

Conclusion

So you see, there is no package construct has to look like your portfolio construction . Judging by many other opinions my current P2P value in the portfolio already very high (perhaps too high?) And I have a good sized lump in Bondora are unlike the rest. Here, it is so well for me in the future something rectify and to use the personal loans to my advantage and generate no disadvantage from it. Because a lack of diversification (also in terms of the platform) can have serious consequences.

was on the other side, a high value in the portfolio structure can ensure to cover losses in other asset classes, as with me last year the case. Sometimes I had there not such a lucky hand, through my investment on the P2P platforms, I could the year but still a positive conclusion.

I believe in an interesting and profitable future of P2P asset class . But the most important thing in my eyes is, as always understand the investment before you invest a dime in one asset class. This gives you the confidence, best assess your personal risk.

What is your portfolio construction? You invest a percentage more or less in P2P than me. Write it in the comments or share them in our community.